Ticket pricing and distribution for major concerts, festivals, and live events has become a complex ecosystem with many competing interests at play.

Historically, third party ticketing platforms and resellers provided ticketing distribution at scale and ensured a free market determined prices - that is that organic demand from fans could dictate the price at which ticket's were resold.

But over the last ten to twenty years, free market demand has been interceded by corporation-like ticket scalping and an ever growing consolidation of ticketing by monopolies that verticalise ticketing into a walled garden that is hard to escape from.

With such shifting power dynamics, the question arises: should event organisers and artists control more of the ticketing chain themselves? Or does that risk reducing consumer benefits and anti-competitive behavior? Let's look into it further.

The Artist and Promoter Perspective

In recent years, major recording artists like Bruce Springsteen as well as special event promoters like Comedy Central have chosen to bypass big external ticketing companies. They believe by controlling inventory fully in-house, they can capture more value, nurture a direct fan connection, and prevent predatory scalping from eating into revenues.

Without third party fees and external resale markups, they argue ticket prices can be set closer to face-value for most fans. Even if some tickets are sold at a premium, this at least generates income for artists rather than brokers. Higher overall supply could also reduce the need for consumers to turn to secondary markets.

While building internal capacity has overhead, solutions have arose that have made ticketing technology much more accessible such as white-label solutions and cost-effective cloud hosting. For the independent artists and promoters, going their own way may incentivize new channels with better economics. Their scale and leveraging artist brands directly gives confidence this can be executed successfully.

Insights From The Free Market

Economic theory argues that enabling ticket resale helps set pricing at a market clearing equilibrium point, even if it feels unfair to those priced out initially.

One frequently cited paper on this is "An Economic Analysis of the Market for Scalping" (Courty, 2003). The researcher analyzes ticket pricing data from the secondary market for popular concerts to study if it leads to efficient allocation and price discovery. The core argument made is that ticket brokers provide valuable information on latent demand which helps venue and event organizers adjust supply appropriately. This helps find the true market clearing price point, maximizing attendance and revenues. It may feel unfair if some fans get priced out of high demand events, but the alternative of underpricing leads to excess demand and economic deadweight loss. To quote the author - "anti-scalping legislation could be inappropriate. In particular, it seems likely that scalpers allow venues to achieve efficient capacity usage in the face of uncertain demand and supply."

Leslie and Sorensen (2021) also analyze scalping market efficiency looking at a case study of a single Garth Brooks event. Their data shows that removing price ceilings and restrictions leads to increased consumption, achieving allocative efficiency even if perceived unfairly. As seen earlier with Courty, ticket brokers signal real demand which otherwise organizers fail to capture in a controlled system. Other analyses of NFL tickets resale (Drayer et al, 2012) find higher secondary market sales per game with more efficient allocation. The evidence generally points to unrestricted resale markets enabling equilibrium clearing price discovery.

There is also skepticism that vertical control avoids conflicts of interest successfully. Critics point to Monopolies, which manage artists, own venues, promotes tours, and also operates their own ticketing platform. Such consolidation of power across the entire industry pipeline goes against the spirit of consumer choice and competition. These incumbents over the past decade has aggressively pursued an integrated business model spanning artist management, event promotion, venue ownership, and ticketing platform operations under a single corporate umbrella.

This creates an inherent anti-competitive environment as the incumbent can prioritize its own events and artists when scheduling tours and arena bookings rather than basing it on neutral supply-demand dynamics. At the same time, fans wanting to attend events have little choice but to transact via the integrated platform given its dominant market share. Service fees on the platform have increased over time while consumer experience lags behind innovation seen in other e-commerce sectors.

Essentially the monopoly sits on all sides of the artist-venue-fan equation, limiting both consumer choice on buying options as well as fair access for independent promoters and talent trying to enter the industry. Both US and European regulators have tried to intervene via anti-trust lawsuits and probing mergers but with limited success so far.

Finding the Middle Ground - Secondary Sales Set & Controlled by the Organisers

So with both sides of the equation in mind, how do artists and organizer stay in control of their ticketing, offer fans a fair experience and crucially keep third parties from extracting revenue from the event lifecycle?

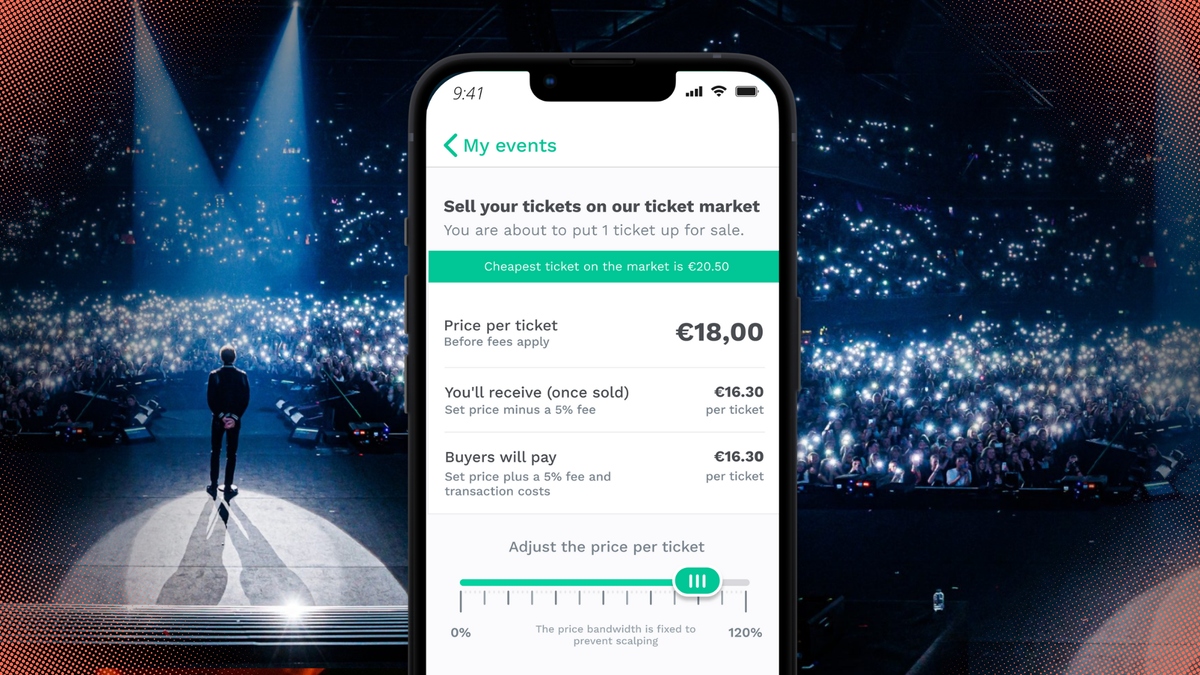

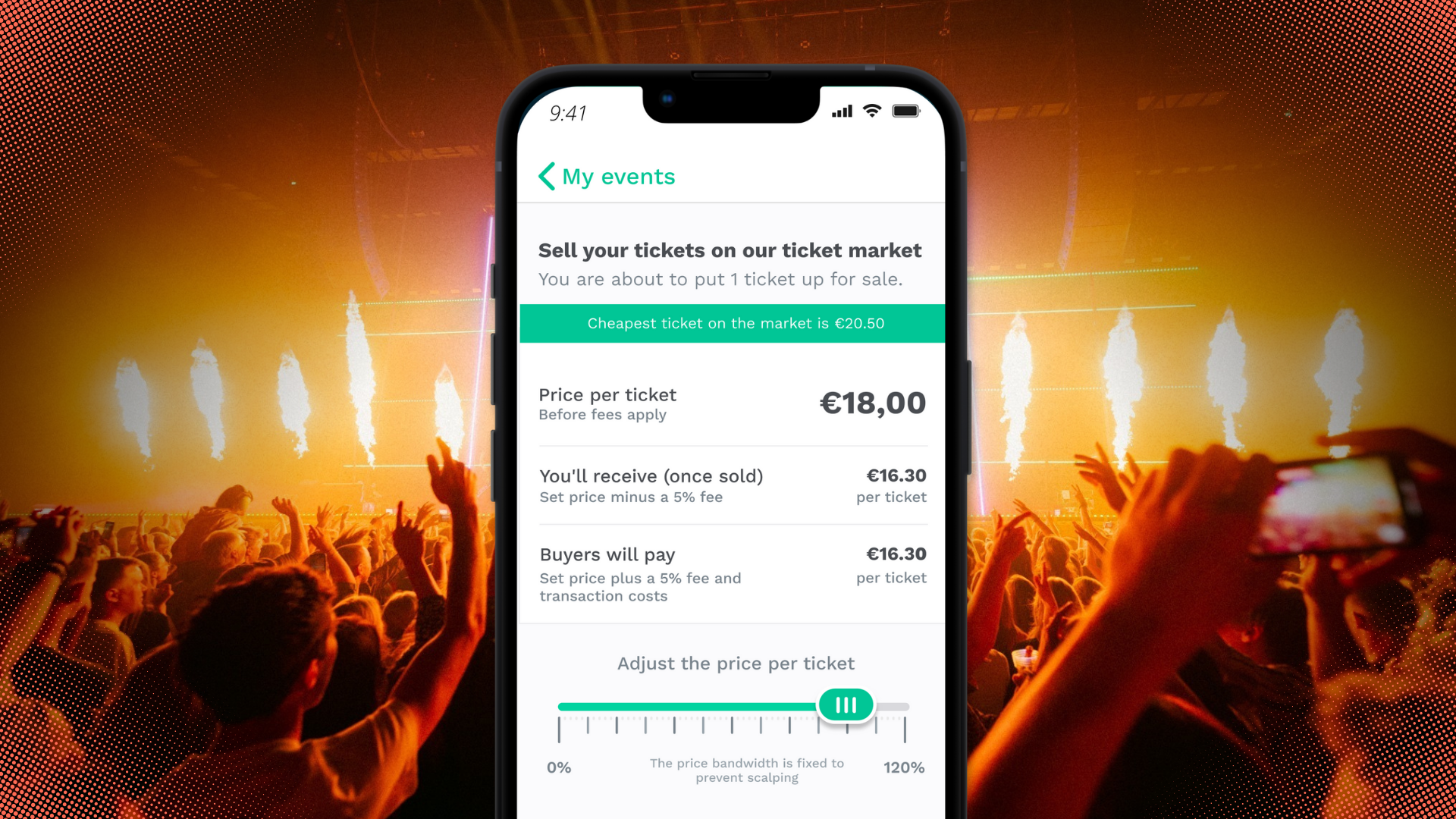

The answer in our mind comes down to integrated primary and secondary marketplaces, where fans are free to re-sell their ticket but at the rules set by the organisers. Whether it's a cap at 120% of the face value ticket or even strictly permitting only face value re-sale - this allows the free market to explore demand, whilst ensuring excessive gouging is kept away.

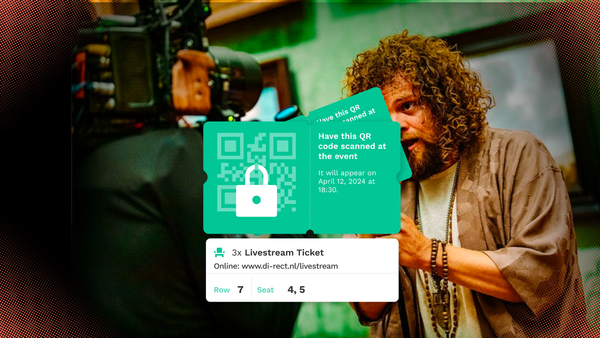

Solutions such as the infrastructure we've built at GUTS aims to provide this best of both worlds ethos and we've seen great success with large artists such as Antoon, Jochem Myjer and his chuckle worthy performances and the effects at large venues like the Ziggo Dome.

After all trust between fans, artists, regulators and commercial players holds the key to harmony and we hope that the industry will continue to drift towards a power balance that puts the creators back in the driving seat.

Want to read more about independent artist successes? Then our Antoon success story is for you: